Oko

Quote:

Oko is an Ethereum explorer focused on smart contracts.

It is intended for a public of experienced Ethereum developers. It was developed to fill a gap in the tools available out there that wouldn't show enough information about smart contracts.

Oko tries to get the source & ABI of verified contracts, and uses Panoramix to decompile contracts without code.

It also tries to interpret the input data for all calls made to contracts, to display it in an understandable form.

It is intended for a public of experienced Ethereum developers. It was developed to fill a gap in the tools available out there that wouldn't show enough information about smart contracts.

Oko tries to get the source & ABI of verified contracts, and uses Panoramix to decompile contracts without code.

It also tries to interpret the input data for all calls made to contracts, to display it in an understandable form.

Review:

Oko is an Ethereum smart contract explorer that allows you to investigate the rules set up in smart contracts. It is a good way to reveal the inter-workings of a smart contract and analyze if it is a scam or a worthy contract.

Posted: 2 years 4 months ago

Wild Credit

Quote:

Wild is a permissionless lending protocol featuring isolated lending pairs.

Lenders supply assets into any of the lending pairs to earn interest. Borrowers pay interest to borrow while collateralizing their loans. The protocol earns an interest rate spread.

Lenders supply assets into any of the lending pairs to earn interest. Borrowers pay interest to borrow while collateralizing their loans. The protocol earns an interest rate spread.

Review:

Wild Credit allows isolated lending pairs, dynamic interest rates, single-sided LP tokens, no impermanent loss and utilizes the WILD token.

Posted: 2 years 4 months ago

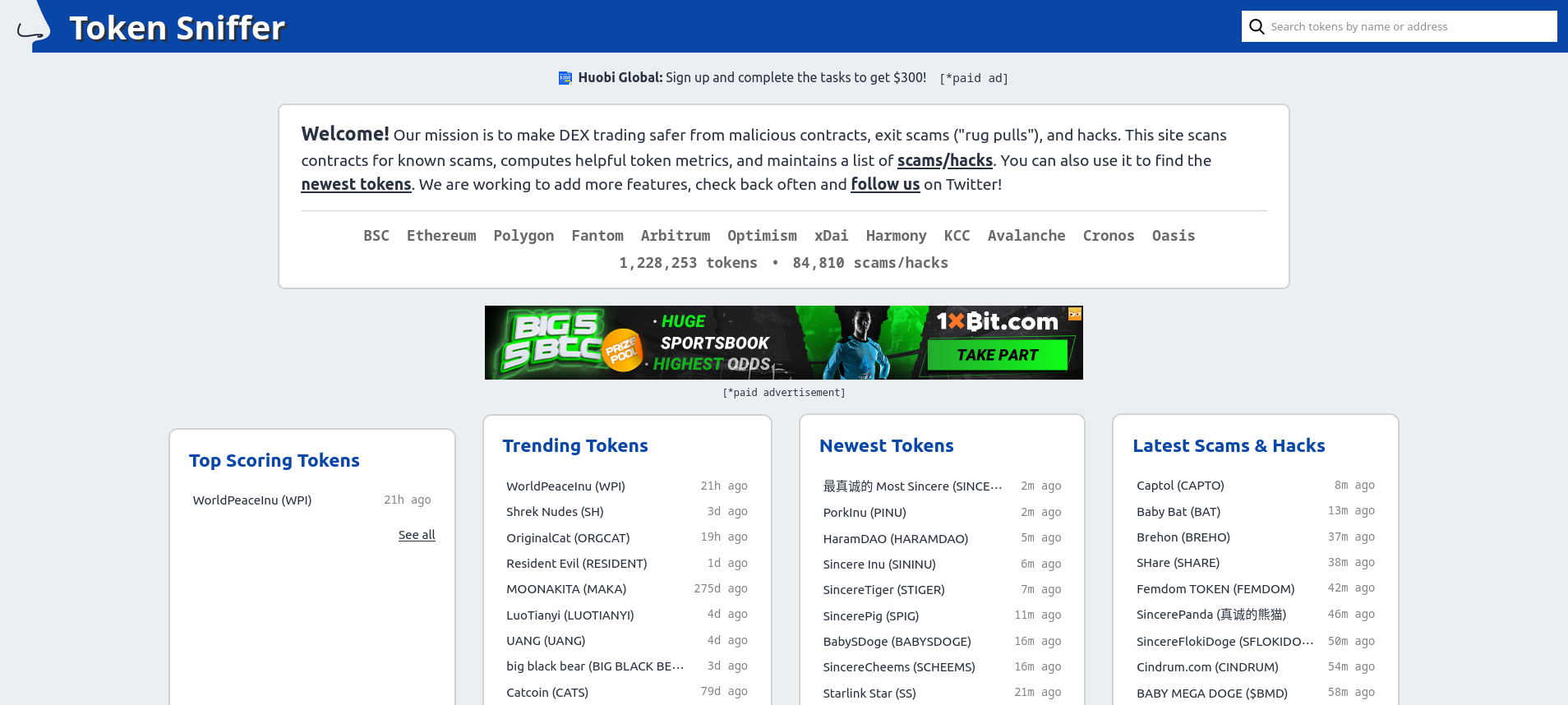

Token Sniffer

Quote:

Our mission is to make DEX trading safer from malicious contracts, exit scams ("rug pulls"), and hacks. This site scans contracts for known scams, computes helpful token metrics, and maintains a list of scams/hacks. You can also use it to find the newest tokens. We are working to add more features, check back often and follow us on Twitter!

Review:

Token Sniffer gives additional information about token smart contracts. In particular, it helps users uncover any potential signs of a rug pull token scam. Quite useful when analyzing new tokens that come onto the market, most often into decentralized exchanges.

Posted: 2 years 4 months ago

Kadena

Quote:

Kadena is a braided, parallelized proof-of-work consensus mechanism that improves throughput and scalability while maintaining the security and integrity found in Bitcoin.

Pact is a human readable and Turing Incomplete smart contract language purpose-built for blockchains with powerful security features including full Formal Verification of user code, error messages, contract upgradability, support for interoperability, and strong permission and access control.

With 20 chains, the Kadena blockchain platform achieves an industry-leading 480,000 transactions per second.

Pact is a human readable and Turing Incomplete smart contract language purpose-built for blockchains with powerful security features including full Formal Verification of user code, error messages, contract upgradability, support for interoperability, and strong permission and access control.

With 20 chains, the Kadena blockchain platform achieves an industry-leading 480,000 transactions per second.

Review:

Kadena is a proof of work blockchain built for scalability, aiming to provide the security of Bitcoin and an ecosystem to foster decentralized smart contracts.

Posted: 2 years 6 months ago

Convex

Quote:

Convex allows Curve.fi liquidity providers to earn trading fees and claim boosted CRV without locking CRV themselves. Liquidity providers can receive boosted CRV and liquidity mining rewards with minimal effort.

If you would like to stake CRV, Convex lets users receive trading fees as well as a share of boosted CRV received by liquidity providers. This allows for a better balance between liquidity providers and CRV stakers as well as better capital efficiency.

Convex has no withdrawal fees and minimal performance fees which is used to pay for gas and distributed to CVX stakers.

CRV stakers and liquidity providers also receive liquidity mining rewards in the form of CVX.

If you would like to stake CRV, Convex lets users receive trading fees as well as a share of boosted CRV received by liquidity providers. This allows for a better balance between liquidity providers and CRV stakers as well as better capital efficiency.

Convex has no withdrawal fees and minimal performance fees which is used to pay for gas and distributed to CVX stakers.

CRV stakers and liquidity providers also receive liquidity mining rewards in the form of CVX.

Review:

Convex is a Curve boosting protocol that enables CRV token holders to earn more than the typical rewards earned on the Curve.fi protocol.

Posted: 2 years 6 months ago

DEX Screener

Quote:

Tracking and charting your favorite DEX in realtime

Review:

Super dex aggregator and resource to track new pairs, trends, nano caps and more across many defi ecosystems!

Posted: 2 years 6 months ago

Umbria

Quote:

Earn High APY with No Impermanent Loss, Using Umbria DeFi.

Get high yields by staking your crypto assets. Stake UMBR in the bridge pool, and receive ETH, WBTC, USDT, USDC, & GHST. Migrate your assets across chains, using the fastest and lowest-cost cross-chain bridge.

The Umbria ecosystem has three major protocols:

- A Cross-chain Asset Bridge; enabling the transfer of assets between otherwise incompatible blockchains and cryptocurrency networks.

-A Staking Pool, where users can earn interest on their crypto-assets by providing liquidity to the bridge. Liquidity providers of UMBR earn a portion of all fees generated by the bridge.

- A Decentralised Exchange (DEX); and automated liquidity protocol powered by a constant product formula, deployed using smart contracts, governed entirely on-chain.

Get high yields by staking your crypto assets. Stake UMBR in the bridge pool, and receive ETH, WBTC, USDT, USDC, & GHST. Migrate your assets across chains, using the fastest and lowest-cost cross-chain bridge.

The Umbria ecosystem has three major protocols:

- A Cross-chain Asset Bridge; enabling the transfer of assets between otherwise incompatible blockchains and cryptocurrency networks.

-A Staking Pool, where users can earn interest on their crypto-assets by providing liquidity to the bridge. Liquidity providers of UMBR earn a portion of all fees generated by the bridge.

- A Decentralised Exchange (DEX); and automated liquidity protocol powered by a constant product formula, deployed using smart contracts, governed entirely on-chain.

Review:

Umbria is a defi app where you can stake your assets for rewards, bridge assets across chains, and earn high APYs with no impermanent loss. It also has extensive documentation and an API.

Posted: 2 years 6 months ago

Coindix

Quote:

As you know, projects on the DeFi ecosystem are like building blocks. DeFi projects are interoperable and often are built on top of each other, creating infinite possibilities. However, the current DeFi ecosystem is fragmented and difficult to navigate.

The mission of Coindix is to gather pieces of the DeFi ecosystem in one place and under one simple and intuitive interface.

The mission of Coindix is to gather pieces of the DeFi ecosystem in one place and under one simple and intuitive interface.

Review:

Excellent index of defi protocol vaults comparing APYs across the projects and ecosystem blockchains. Allows you to filter by LP staking, single staking, no impermanent loss and stablecoins.

Posted: 2 years 6 months ago

Chainge

Quote:

When it comes to cross-chain, Chainge is the leading authority in the DeFi space. With 13 integrated chains and counting, the app supports over 75 assets so that users can maximise their wealth’s potential and enjoy a secure, flexible & worry-free financial life.

Review:

Based on the FUSION (FSN) blockchain, Chainge utilizes the Multichain (Anyswap) backend to offer banking and bank services to everyday users.

Posted: 2 years 6 months ago

Multichain

Quote:

Multichain is the ultimate Router for web3. It is an infrastructure developed for arbitrary cross-chain interactions.

The solutions developed by Multichain allow almost all blockchains to inter-operate. There is no restriction to Ethereum like chains (e.g. Binance Smart Chain), or different Layer 2 chains requiring finality to Ethereum (e.g. Polygon), or a network of Parachains (e.g. Moonbeam in the PolkaDot system), or Bitcoin types of chain (e.g. Litecoin), or COSMOS chains (e.g. Terra). These are either now all integrated, or on course for integration. With support for all ECDSA and EdDSA encrypted chains, Multichain is almost universally applicable as an interoperable layer.

The solutions developed by Multichain allow almost all blockchains to inter-operate. There is no restriction to Ethereum like chains (e.g. Binance Smart Chain), or different Layer 2 chains requiring finality to Ethereum (e.g. Polygon), or a network of Parachains (e.g. Moonbeam in the PolkaDot system), or Bitcoin types of chain (e.g. Litecoin), or COSMOS chains (e.g. Terra). These are either now all integrated, or on course for integration. With support for all ECDSA and EdDSA encrypted chains, Multichain is almost universally applicable as an interoperable layer.

Review:

Multichain is a cross-chain bridge and ecosystem interconnecting 1215+ project tokens and 27 blockchains, compiled into a unified cross-chain interface.

Posted: 2 years 6 months ago